Why You’re Broke Before Month-End

It’s payday. Your M-Pesa balance is smiling, you promise yourself this month will be different. Two weeks later, you’re wondering who sent your salary to an early grave.

The problem isn’t that you don’t earn enough it’s that you don’t have a clear plan for your money.

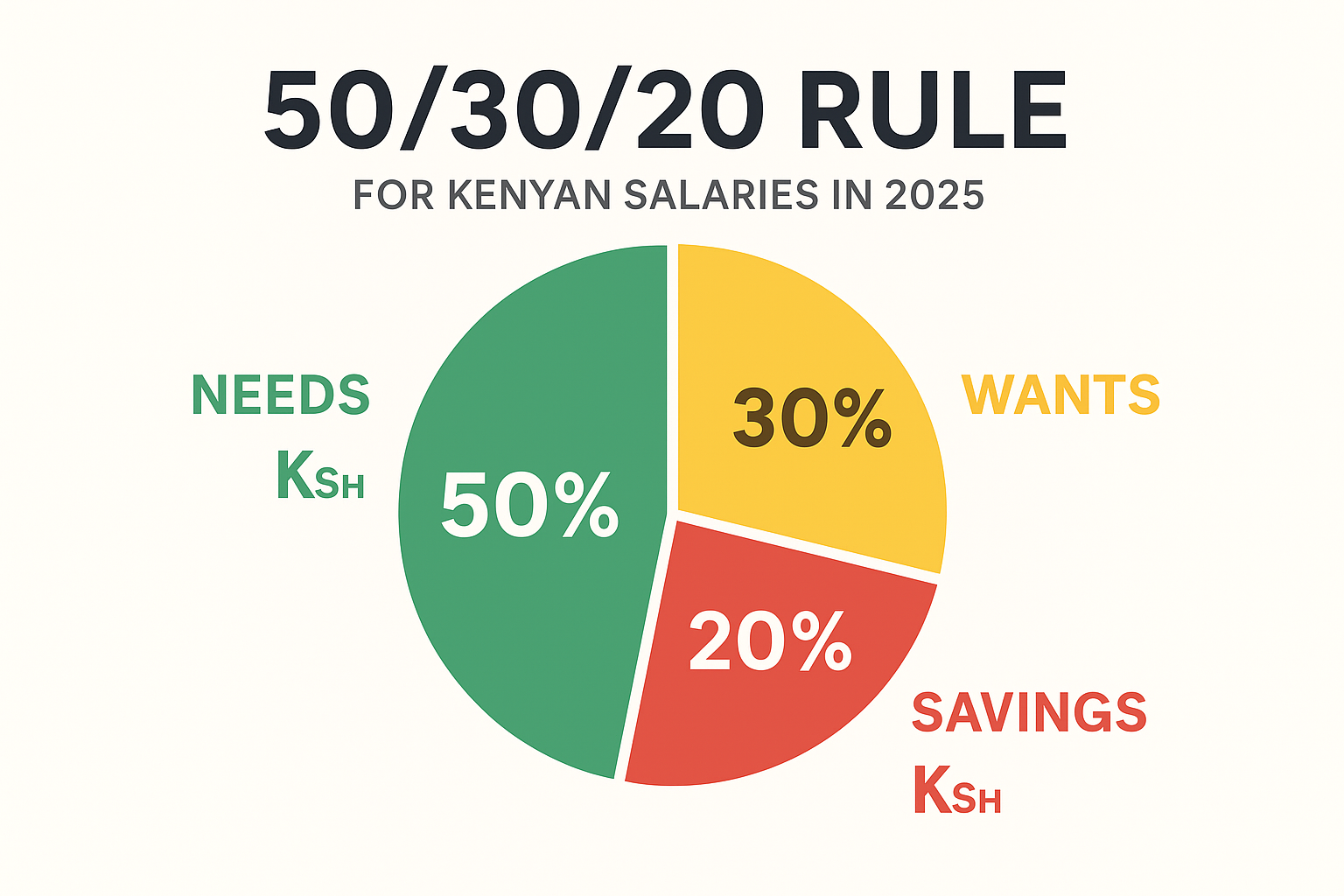

This is where you introduce the 50/30/20 rule, a simple budgeting formula that has helped millions worldwide take control of their finances and it works in Kenya, too.

1. What is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting framework that divides your monthly income into three categories:

50% – Needs: Rent, utilities, food, transport, school fees, insurance.

30% – Wants: Dining out, entertainment, shopping, travel.

20% – Savings/Debt Repayment: Emergency fund, investment contributions, paying off loans.

This formula works because it forces you to prioritize essentials, enjoy life without guilt, and still build financial security.

2. Applying the Rule to a Kenyan Salary

Let’s say you earn KSh 50,000 per month after taxes.

Here’s how the 50/30/20 split would look:

Here’s how the 50/30/20 split would look:

Needs (50%): KSh 25,000

1. Rent: 12,000

2. Utilities: 3,000

3. Food & groceries: 7,000

4. Transport: 3,000

1. Rent: 12,000

2. Utilities: 3,000

3. Food & groceries: 7,000

4. Transport: 3,000

Wants (30%): KSh 15,000

. Eating out: 5,000

. Netflix, Spotify, TV subscriptions: 2,000

. Shopping, hobbies, trips: 8,000

. Eating out: 5,000

. Netflix, Spotify, TV subscriptions: 2,000

. Shopping, hobbies, trips: 8,000

Savings/Debt (20%): KSh 10,000

. Emergency fund: 5,000

. Sacco contributions: 3,000

. Loan repayment: 2,000

. Emergency fund: 5,000

. Sacco contributions: 3,000

. Loan repayment: 2,000

3. Adapting it for Kenyan Realities

Let’s be honest, Nairobi rent alone can eat 40–50% of your income. So here’s how to make it work:

1. Lower rent costs: Consider house-sharing, moving further from CBD, or negotiating with landlords.

2. Boost income: Add a side hustle like freelance writing, baking, boda dispatch, or online tutoring.

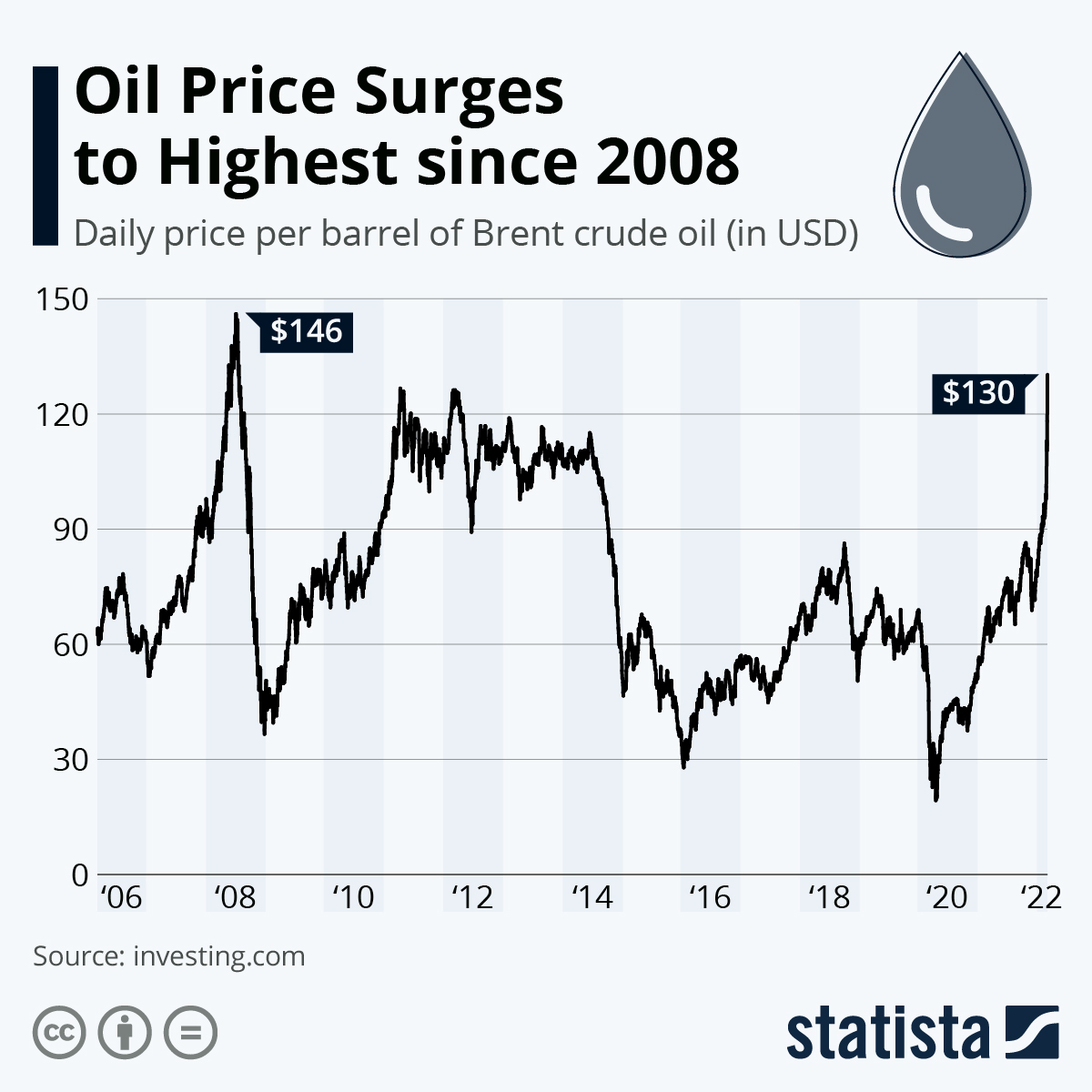

3. Fight inflation: Buy dry goods in bulk, use farmer’s markets, and watch daily expenses.

2. Boost income: Add a side hustle like freelance writing, baking, boda dispatch, or online tutoring.

3. Fight inflation: Buy dry goods in bulk, use farmer’s markets, and watch daily expenses.

4. Tools to Help You Stick to the Plan

1. M-Ledger: Tracks your M-Pesa transactions automatically.

2. Mint or Excel Sheets: For a custom, detailed budget.

3. Envelope Method: Withdraw cash for needs/wants and keep them separate.

5. Common Mistakes to Avoid

. Wants disguised as needs: That latest phone upgrade? Probably a want.

. Saving last instead of first: Automate savings right after payday.

. Ignoring irregular expenses: Budget for annual items like school fees and insurance.

Your Challenge for Next Payday

Try the 50/30/20 rule for just one month. Track your spending, adjust as needed, and see how much more in control you feel.