August 19, 2025

The New Tech Gold Rush

Generative AI has become the dominant engine of U.S. economic expansion, accounting for a staggering 59% of real GDP growth in the first half of 2025 through massive investments in information technology infrastructure. This unprecedented capital allocation dwarfs the dotcom boom of the late 1990s, with the "Magnificent Seven" tech giants alone driving half the S&P 500's 2024 gains. Yet this investment frenzy exists alongside a startling contradiction: nonresidential investment in traditional structures—factories, warehouses, and commercial buildings—has collapsed as tariff uncertainty paralyzes decision-making. The Deloitte Global Economics Research Center notes this divergence represents a "historic reorientation of capital," where political risk is reshaping economic geography in real-time.

The Global Tariff Mosaic

The architecture of global trade has fractured under the weight of politically weaponized tariffs:

- Discriminatory Duty Regime: U.S. tariffs now average 18.3%—levels unseen since the Great Depression—with punitive 50% rates targeting Brazil (over Bolsonaro prosecutions), 35% on Canada (for Palestine recognition), and 15% blanket rates for the EU and Japan secured through negotiated investment pledges.

- Supply Chain Roulette: Despite temporary clarity, over 30% of U.S. imports remain in limbo pending negotiations with China, Mexico, and Canada. The imminent 2026 USMCA renegotiation guarantees prolonged uncertainty, forcing multinationals to maintain parallel supply chains at enormous cost.

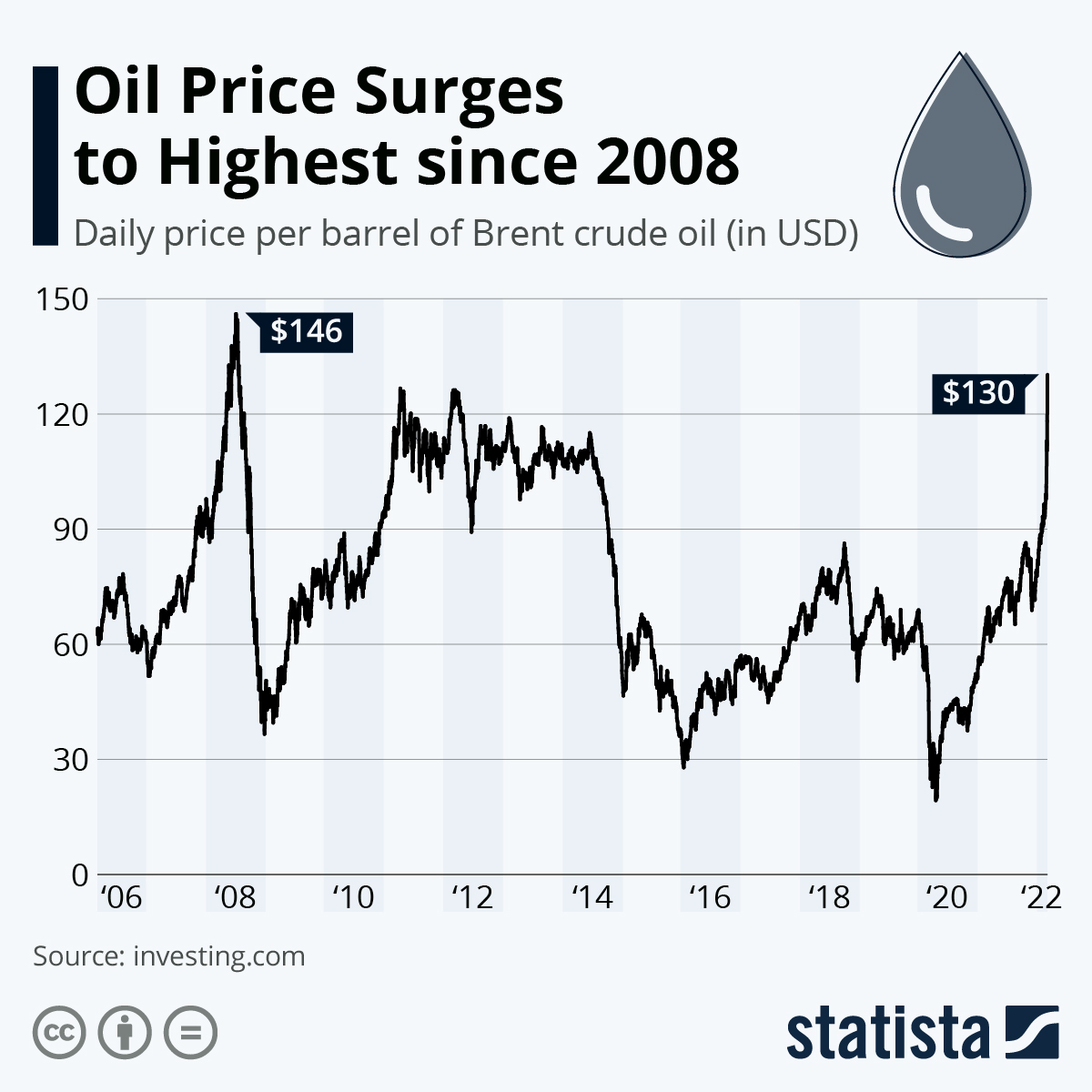

- Inflation Asymmetry: These policies act as supply shocks in tariff-imposing economies (accelerating inflation) while creating demand shocks elsewhere (amplifying disinflation). S&P Global's purchasing manager surveys show U.S. selling prices now imply 4% consumer inflation—double the Eurozone's stable 2% rate—as import costs finally penetrate corporate margins after months of absorption.

"Trade policy has become a key vector for global inflation, challenging the conventional playbook for businesses and central banks."

EY Global Economics Research

AI's Energy Paradox

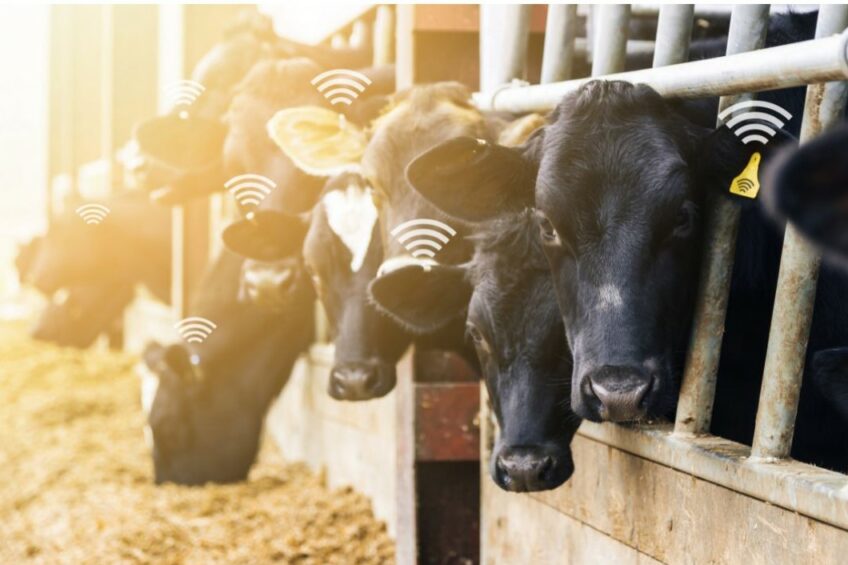

The computational hunger of generative AI threatens to destabilize global energy systems:

- Electricity Demand Surge: Data centers will consume half of U.S. electricity demand growth through 2030—equivalent to Japan's entire current usage—according to International Energy Agency projections. This comes as renewable energy subsidies shrink, guaranteeing higher household energy costs.

- Carbon Conundrum: While 50% of new U.S. power capacity involves renewables, the sheer scale of demand forces reliance on fossil fuels. European natural gas prices already trend upward (+1.6% monthly) with reserves below historical averages, creating winter risk.

- Industrial Displacement: By 2030, U.S. data centers will consume more electricity than all energy-intensive manufacturing (steel, cement, chemicals combined), potentially offshoring industrial capacity to regions with cheaper power.

Monetary Policy in the Crosshairs

Central banks confront divergent inflation paths fueled by AI and trade policies:

- Transatlantic Split: The ECB holds at 2% amid anchored inflation, while the Fed maintains 4.375% rates despite weakening employment, betting tariff-driven inflation will prove transitory. Market pricing suggests 60 basis points of Fed cuts by year-end, but July's hawkish minutes support a December-only move.

- Productivity Gambit: The Congressional Budget Office estimates that if AI boosts total factor productivity growth by just 0.5 percentage points annually, U.S. debt could fall to 113% of GDP by 2055 versus 156% under baseline—a $10 trillion swing. Yet history shows such payoffs take decades, as with 1980s computing investments.

- Emerging Market Dilemma: Brazil hikes rates to 15% despite growth concerns, while India aggressively cuts (50 bps to 5.5%) betting on domestic demand. This fragmentation reflects the lack of synchronized global recovery.

The Productivity Paradox

Generative AI's economic promise faces a harsh reality check:

- Output Without Yield: Like the 1990s tech boom, massive investment hasn't translated into measurable productivity gains. Worker displacement outpaces reskilling, particularly in knowledge sectors like legal services and software engineering.

- Labor Market Disruption: McKinsey surveys reveal AI investment as the top corporate priority globally, yet trade policy uncertainty ranks as the greatest growth disruptor—creating strategic schizophrenia as firms simultaneously chase innovation while battening hatches.

- Debt Overhang: With U.S. public debt at 117% of GDP (multidecade highs), the CBO warns that absent AI-driven productivity miracles, interest costs will consume 35% of federal revenue by 2040. Immigration restrictions exacerbate this, potentially eliminating 1 million workers annually through deportations.

Rearrangement Imperative

Global supply chains face a Darwinian reshuffle:

- Replacement Ratios: McKinsey analysis shows only 35% of U.S. imports from China have readily available alternatives at scale (ratio <0.1). Critical inputs like rare earth magnets (ratio >1.0) face near-impossible substitution, threatening manufacturing paralysis.

- European Opportunity: Modeling identifies the EU as the primary beneficiary of U.S.-China decoupling, particularly in machinery and pharmaceuticals. German fiscal stimulus ($100 billion defense/industry package) strategically targets these gaps.

- Emerging Market Vulnerability: Pegged currencies like the Hong Kong dollar face extreme pressure as the greenback hits 25-year highs. Countries with dollar-denominated debt see refinancing costs surge 30% year-on-year.

The Fragile Equilibrium

Generative AI represents both salvation and threat to the global economy. Its capital surge props up growth amid trade fragmentation, yet its energy demands and unproven productivity gains risk exacerbating inflation and inequality. The Deloitte Research Center warns electricity costs could spike 40% for U.S. households by 2027 if renewable transitions lag, while the IMF's "tenuous resilience" framing captures the fragility of 3% global growth.

As Jackson Hole convenes central bankers this week, the question isn't whether AI will transform economies—it already does—but whether its second-order effects will trigger the very recessions it currently postpones. In this brittle landscape, the only certainty is that the rules of economic engagement are being rewritten by algorithms and tariffs alike.

Sources: Deloitte Global Economics Research Center, McKinsey Global Institute, KBC Economic Perspectives, EY-Parthenon, IMF World Economic Outlook, S&P Global Market Intelligence