August 19, 2025

Growth Divergence in a Fragmented World

The global economy navigates a precarious path, with growth projected at 3.0% in 2025—among the weakest rates since the 2009 financial crisis outside the pandemic. While the IMF’s July outlook notes a modest upward revision from April, this masks stark regional divergences. The United States, previously the engine of advanced-economy growth, faces a sharp deceleration from 2.8% in 2024 to 1.6% this year, driven by tariff headwinds and fading inventory boosts. Meanwhile, the Eurozone limps toward 0.9% growth, bolstered only by defense spending and infrastructure investments. Emerging markets exhibit resilience, but India and Brazil confront downgraded forecasts due to U.S. trade barriers.

*"Global growth is held hostage by trade policy uncertainty. Tariff front-loading provided ephemeral relief, but the bill comes due in late 2025."*

S&P Global Market Intelligence

Inflation Asymmetry: Goods vs. Services

Inflation dynamics reveal a transatlantic split. Eurozone headline inflation has stabilized near the ECB’s 2% target, allowing policymakers to pause their rate-cutting cycle. In stark contrast, U.S. core goods inflation surged to 1.1% in July—the highest since mid-2023—as tariffs catalyze pass-through effects previously absorbed by corporate margins. S&P Global’s PMI data signals U.S. selling prices consistent with 4% consumer inflation, while the UK braces for a midweek CPI print likely to exceed Bank of England comfort levels, complicating rate-cut plans.

Monetary Policy in the Crossfire

Central banks grapple with conflicting signals:

- Federal Reserve: Markets price in 60 basis points of cuts by year-end, but July’s hawkish FOMC minutes and elevated PPI (3.3% YoY) support a December-only cut. Fed leadership transitions add uncertainty to the inflation fight.

- European Central Bank: A pause at 2.15% reflects confidence in anchored inflation, though trade spillovers and a weakening euro constrain flexibility. President Lagarde’s Jackson Hole speech will test this equilibrium.

- Swiss National Bank: A dovish outlier, it slashed rates to 0% amid deflationary pressures (-0.1% May CPI), though geopolitical risks could revive the franc’s safe-haven appeal.

Generative AI: Economic Savior or Dotcom Redux?

Generative AI dominates U.S. growth narratives, accounting for 59% of H1 GDP expansion through IT infrastructure investments. Yet this boom carries existential risks:

- Productivity Paradox: Like the 1990s tech surge, productivity gains remain elusive. The Congressional Budget Office warns that absent AI-driven TFP growth, U.S. debt could hit 156% of GDP by 2055.

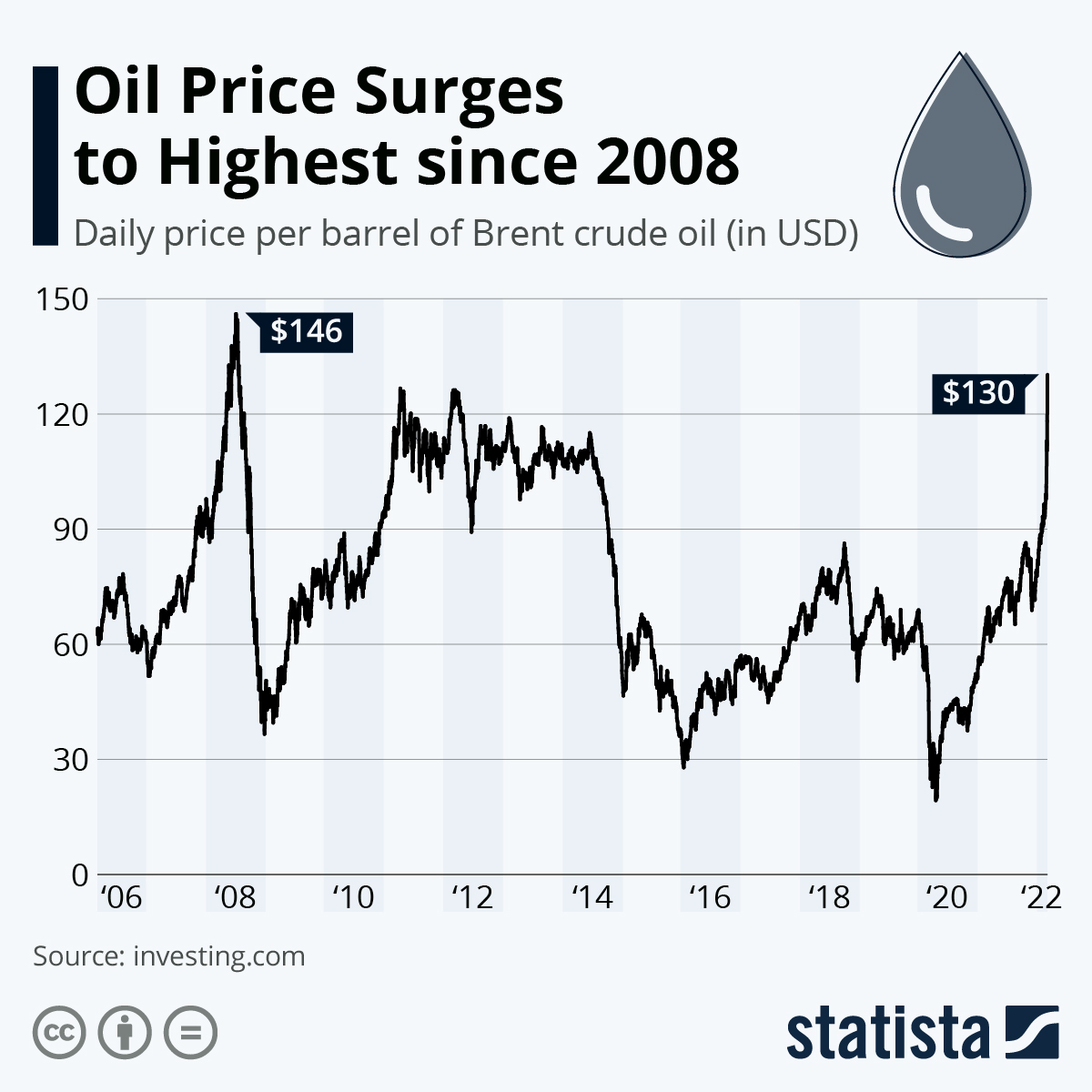

- Energy Shockwaves: Data centers will consume half of U.S. electricity demand growth through 2030—equivalent to Japan’s entire usage—threatening household costs and carbon goals.

- Market Fragility: "Magnificent Seven" stocks fuel equity valuations, echoing dotcom-era concentration. A growth slowdown could trigger broad liquidation.

Trade Policy Uncertainty: The Endless Fog

August’s tariff implementation failed to deliver clarity businesses crave. Three unresolved fault lines threaten supply chains:

- Unfinished Deals: U.S. negotiations with China, Canada, and Mexico remain open, while the USMCA renegotiation looms in 2026.

- Retaliation Risks: The "One Big Beautiful Bill" exacerbates deficits, but reciprocal tariffs could slice 0.5% from global growth by 2026.

- Front-Loading Hangover: Inventory surges artificially buoyed H1 growth; the unwinding may synchronize global slowdowns this quarter .

Geopolitics and Currency Tremors

Safe-haven assets flash warning signs as the Russia-Ukraine conflict enters a decisive phase. Gold’s rally to $3,349/oz and the Swiss franc’s strength reflect market anxiety ahead of the Zelenskyy-Trump summit. Currency markets price divergent fundamentals: sterling thrives on robust UK data, while the euro sinks under political and energy uncertainties.

Jackson Hole: The Next Inflection Point

All eyes turn to Wyoming this week, where Fed Chair Powell and ECB President Lagarde will address critical dilemmas:

- Can central banks coordinate policy amid tariff-driven inflation asymmetry?

- Will Powell signal tolerance for inflation overshoots if growth falters?

- Could a "dovish hold" consensus emerge, prioritizing financial stability over inflation targets?

Historically, this symposium has reshaped policy trajectories; 2025’s edition may determine whether tenuous resilience tips into recession.

The Path Ahead: Fragility Foretold

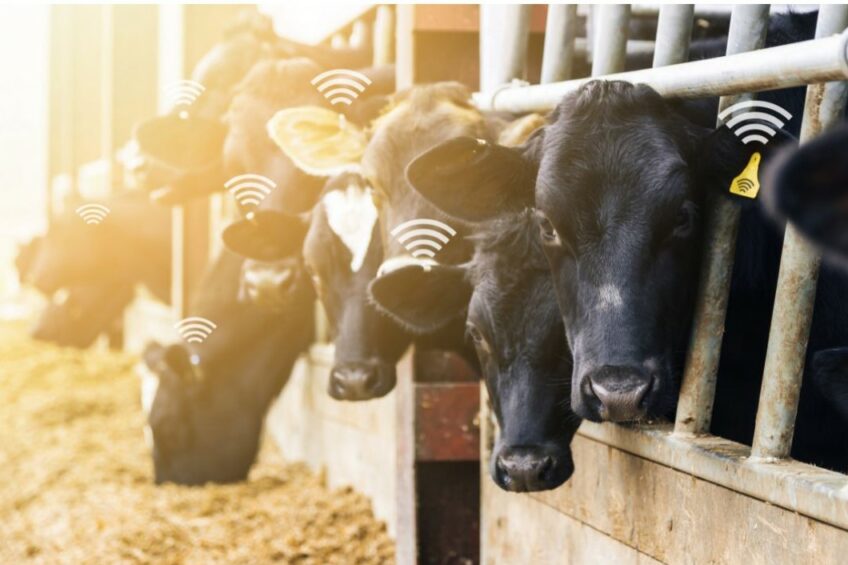

The global economy stands at a crossroads where policy missteps could unravel its fragile equilibrium. Trade uncertainty has already curtailed non-AI business investment, particularly in commercial real estate and manufacturing structures. Immigration restrictions in the U.S. threaten to erase 1 million workers annually via deportations—spiking wages in agriculture, construction, and hospitality. As the Deloitte Research Center warns, this compounds inflationary pressures while stifling output.

The IMF’s "tenuous resilience" framing captures the paradox: upward revisions mask gathering storms. With flash PMIs (Thursday) poised to reveal early tariff impacts and UK inflation data (Wednesday) potentially forcing the BOE’s hand, markets may soon confront the disconnect between AI euphoria and Main Street strain. In this brittle landscape, the only certainty is volatility.

Sources: IMF World Economic Outlook, S&P Global Market Intelligence, Deloitte Insights, NIESR, Central Bank Communications