Kenya just secured ¥25 billion through Samurai bonds. But what are they, and why do they matter for the economy?

What Is a Samurai Bond?

What Is a Samurai Bond?

A Samurai bond is a yen-denominated bond issued by a foreign government or company in the Japanese market. These bonds are attractive for issuers looking to:

- Access Japan's low-interest capital markets

- Diversify their funding sources

- Reduce dependence on dollar- or euro-denominated loans

For investors in Japan, Samurai bonds offer an opportunity to support global projects without taking on foreign exchange risk.

Kenya’s Recent Samurai Deal Quick Facts:

Kenya’s Recent Samurai Deal Quick Facts:

- Amount Raised: ¥25 billion (~$169 million)

- Announced: August 2025 during the TICAD 9 summit in Tokyo

- Backed by: Nippon Export and Investment Insurance (NEXI)

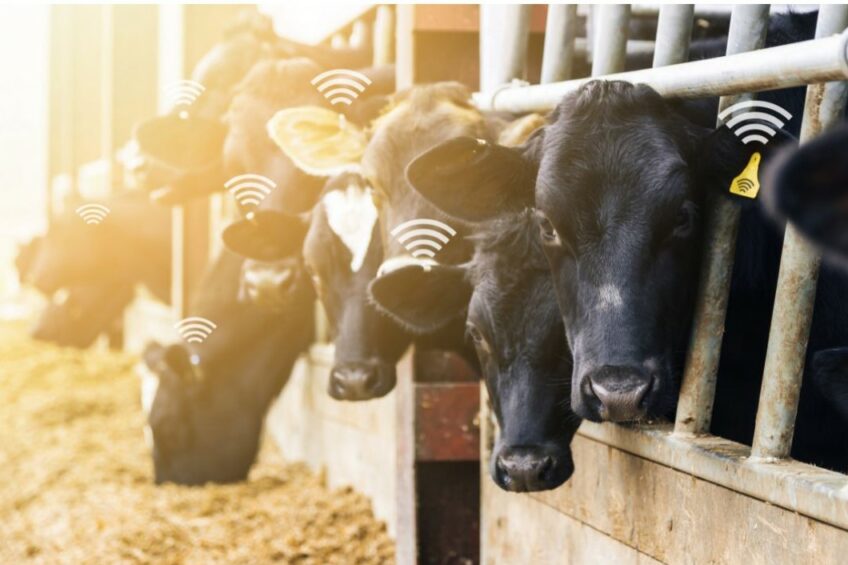

- Purpose: To support Kenya’s vehicle assembly industry and power distribution improvements, especially reducing electricity transmission losses (currently at 23%)

Kenya’s decision to issue Samurai bonds is strategic. Here’s why:

1. Lower Borrowing Costs

Japanese interest rates are among the lowest globally. Issuing in yen means Kenya can potentially lock in more favorable rates than with dollar- or euro-based loans.

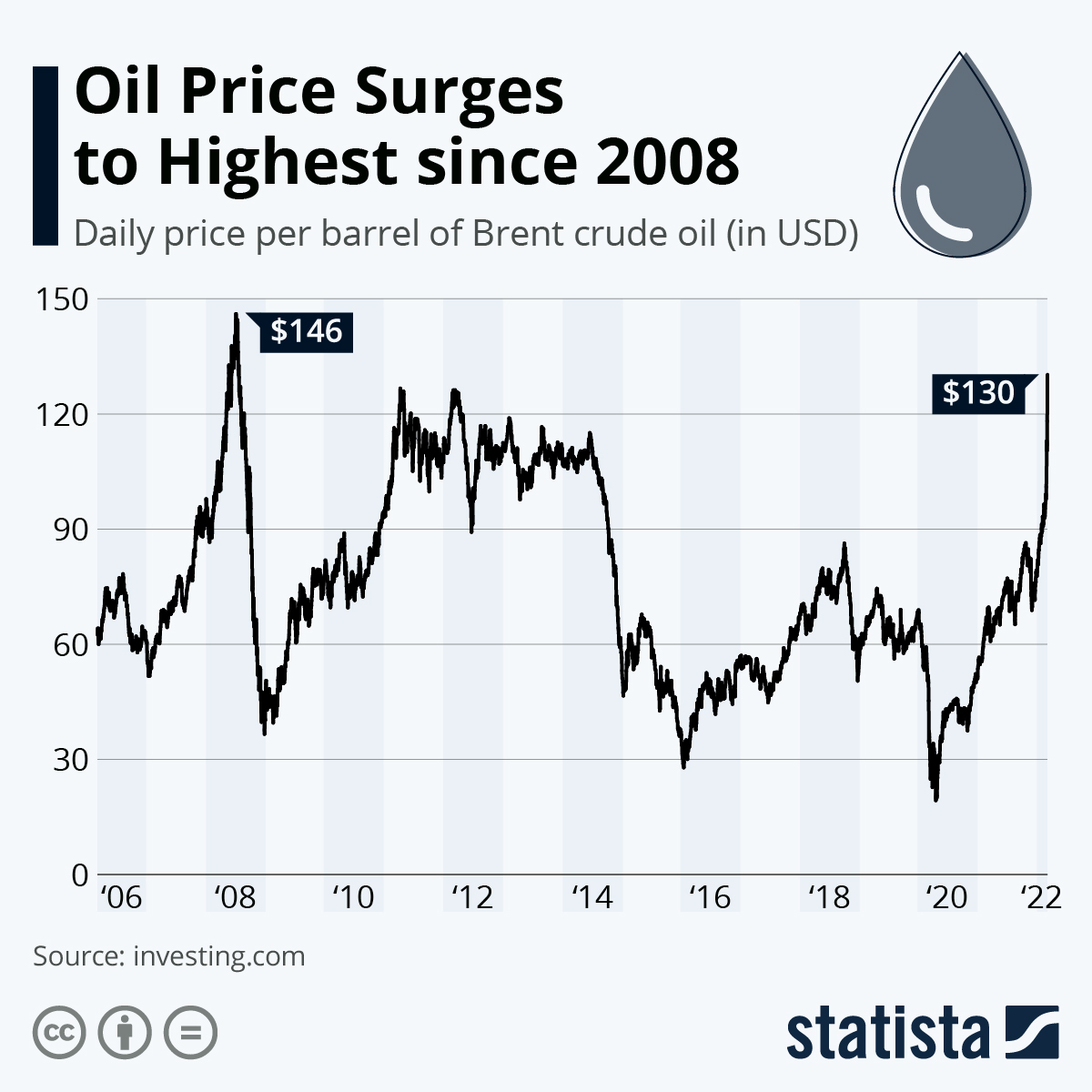

2. Currency Diversification

It reduces over-reliance on the USD, which is risky during global dollar shortages or interest rate hikes by the U.S. Federal Reserve.

3. Attract Long-Term Infrastructure Financing

Japanese investors are traditionally long-term oriented—ideal for infrastructure projects like power grids, roads, and assembly plants.

4. Backed by NEXI

With insurance from Japan’s state-backed NEXI, the bonds carry lower risk, making them more appealing to Japanese institutional investors.

Kenya is not stopping at Samurai bonds. The government is actively exploring:

1. Lower Borrowing Costs

Japanese interest rates are among the lowest globally. Issuing in yen means Kenya can potentially lock in more favorable rates than with dollar- or euro-based loans.

2. Currency Diversification

It reduces over-reliance on the USD, which is risky during global dollar shortages or interest rate hikes by the U.S. Federal Reserve.

3. Attract Long-Term Infrastructure Financing

Japanese investors are traditionally long-term oriented—ideal for infrastructure projects like power grids, roads, and assembly plants.

4. Backed by NEXI

With insurance from Japan’s state-backed NEXI, the bonds carry lower risk, making them more appealing to Japanese institutional investors.

Kenya is not stopping at Samurai bonds. The government is actively exploring:

- Panda Bonds (Chinese yuan-denominated bonds in China)

- Sustainability-Linked Bonds (tied to environmental and social goals)

- Debt swaps and buybacks to smooth out maturing obligations

This trend marks a new era of sophisticated fiscal strategy, balancing development needs with debt sustainability.

As infrastructure needs grow and debt pressures loom, this type of innovative, low-cost financing could play a pivotal role in Kenya’s economic resilience and future growth.

As infrastructure needs grow and debt pressures loom, this type of innovative, low-cost financing could play a pivotal role in Kenya’s economic resilience and future growth.