Kenya has officially abandoned its proposed airport expansion partnership with India’s Adani Group and is now turning to global development banks for funding the ambitious upgrade of Jomo Kenyatta International Airport (JKIA). The shift underscores Kenya’s renewed focus on public-backed financing and long-term infrastructure sustainability.

With a $2 billion expansion plan on the table, including a new terminal and a second runway, this move is being hailed as a strategic course correction in national infrastructure planning.

Originally, the Kenyan government had considered partnering with the Adani Group, an Indian conglomerate with growing influence in infrastructure across Asia and Africa. However, amid growing scrutiny over transparency, sovereignty concerns, and financing terms, the deal quietly fell through.

Now, Kenya is turning to reputable international development financiers such as:

- Japan International Cooperation Agency (JICA)

- China Exim Bank

- German KfW Development Bank

- European Investment Bank (EIB)

- African Development Bank (AfDB)

These institutions are more aligned with public infrastructure goals, typically offering longer-term, lower-interest loans with oversight on project execution.

The JKIA expansion is set to dramatically increase the airport’s capacity and competitiveness in the region. Key components include:

- A new passenger terminal

- A second runway to improve air traffic flow

- Upgraded cargo handling and logistics infrastructure

- Energy-efficient and climate-resilient architecture

This project is designed to solidify Nairobi’s status as East Africa’s primary aviation hub, capable of competing with the likes of Addis Ababa and Kigali.

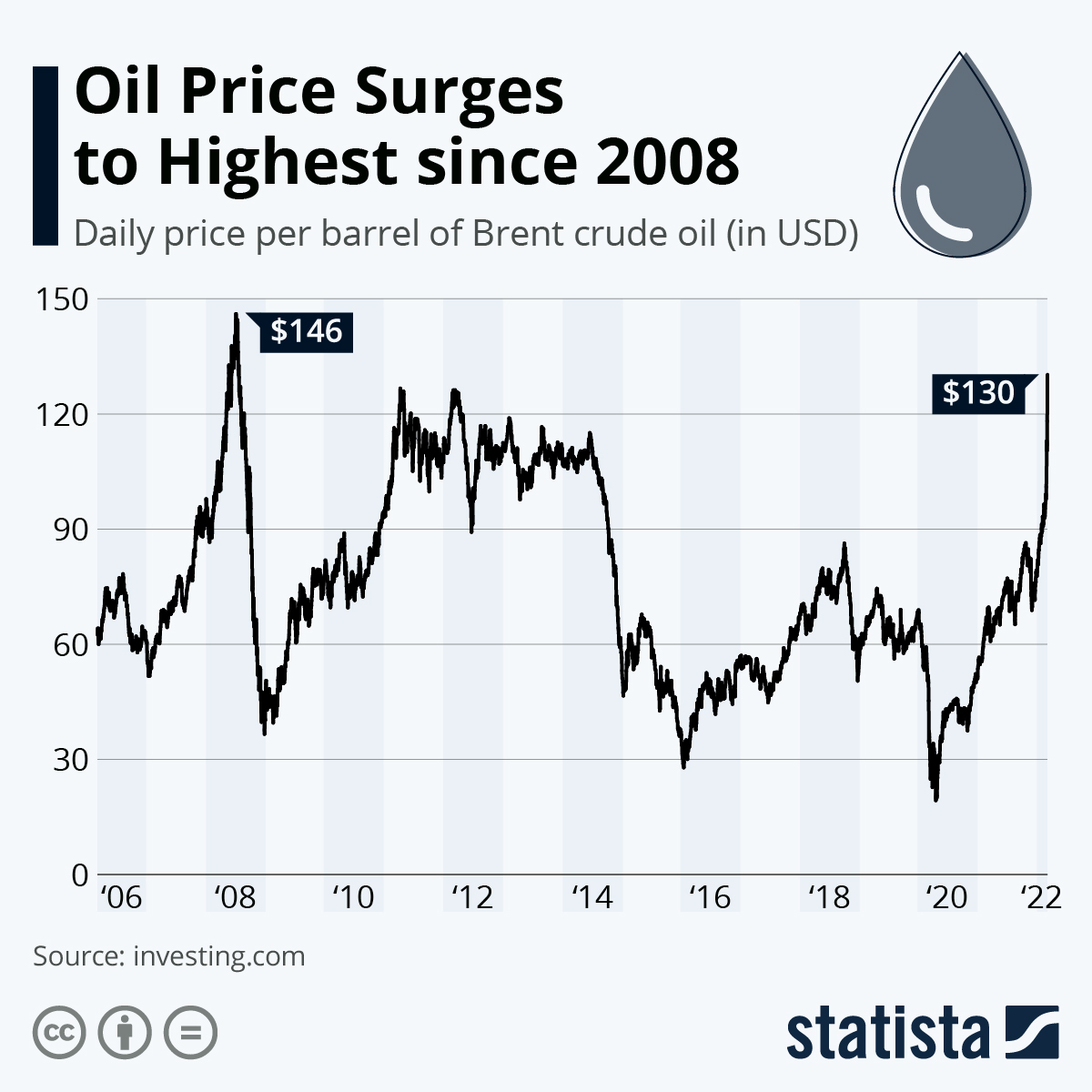

In parallel, Kenya will issue a $1.36 billion securitized bond, backed by fuel levies, to support critical road infrastructure projects. This bond structure ensures steady repayment through predictable revenue streams and is seen as an innovative solution to infrastructure financing without deepening direct public debt.

Why This Move Matters

- Sovereign Control: Development banks offer less commercial pressure and more oversight, protecting Kenya’s national interest.

- Better Terms: More favorable lending terms mean lower debt stress in the long run.

- Sustainability Focus: Institutions like EIB and AfDB incorporate environmental and social governance (ESG) standards in project execution.

- Regional Competitiveness: A modern JKIA is key to attracting global airlines, boosting tourism, and facilitating exports.

Kenya’s pivot away from private mega-deals to multilateral-backed development financing signals a strategic recalibration in its approach to infrastructure growth. By leveraging the trust and structure of international lenders, the country not only secures better financing but also safeguards its long-term economic sovereignty.

As Kenya prepares for takeoff with this new airport expansion, the world is watching and flying along.