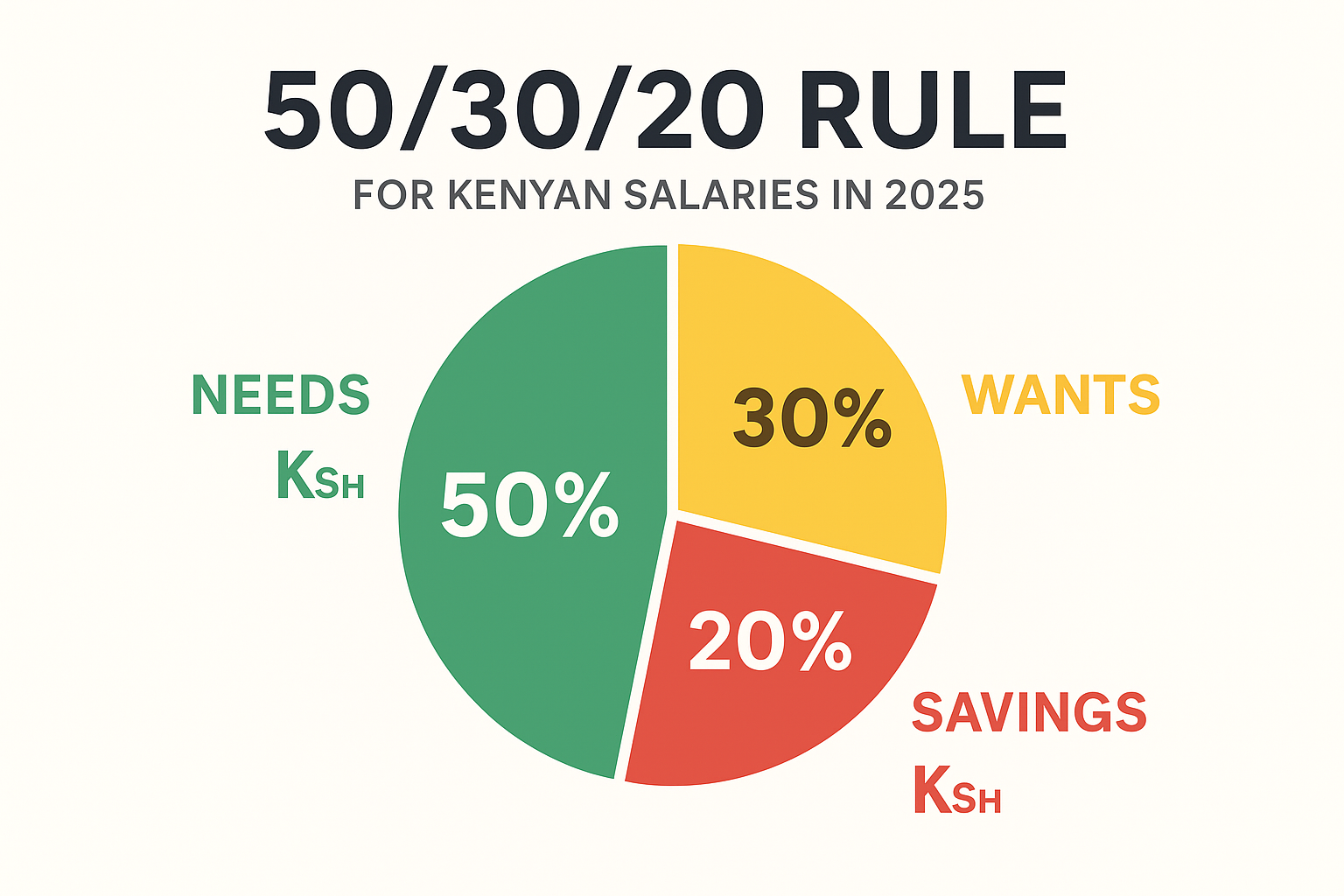

Saving money in 2025 doesn’t have to be complicated it just needs to be intentional. Start by tracking your spending. With so many free budgeting apps available, it’s easier than ever to see where your money goes.

Once you know your habits, look for areas to cut back. Do you really need five different streaming subscriptions or daily takeout lunches? Small cuts can make a big difference over time.

Next, automate your savings. Set up your bank account to move a set amount into a savings or investment account every time you get paid even Ksh 200 a week adds up. Also, take advantage of digital deals.

From cashback apps to online discounts, shopping smart online can save you thousands a year. And if you’re earning from side hustles, treat that income like bonus savings instead of spending money.

Lastly, learn to delay gratification. That latest phone or fashion trend can wait. Focus on needs first, and reward yourself only after hitting your savings goals.

In 2025, the smartest people aren’t just making money, they’re keeping it too. Saving isn’t about being perfect; it’s about being consistent.