August 19, 2025

Dueling Manifestos: Two Visions for AI Dominance

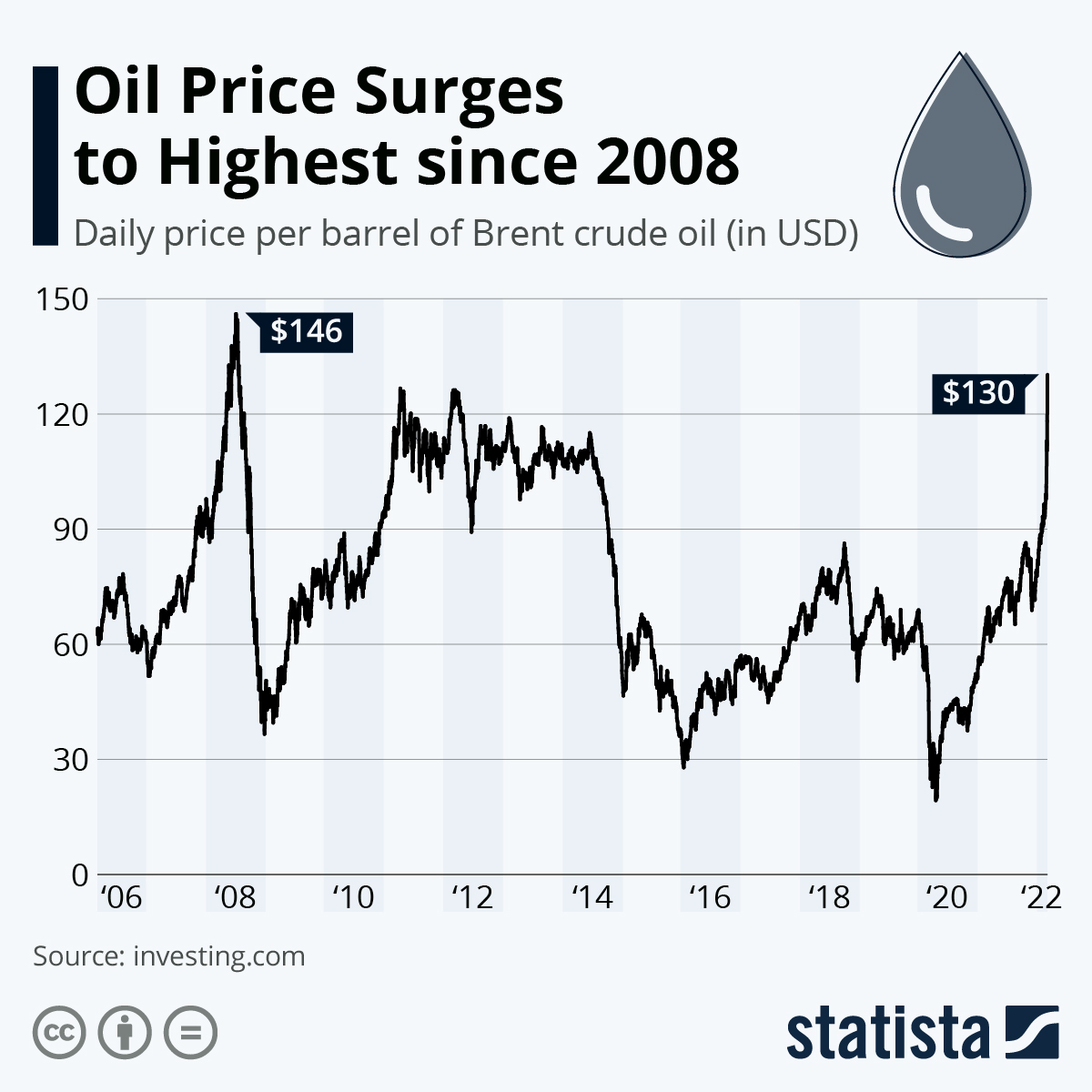

In July 2025, the geopolitical tectonic plates shifted when Washington and Beijing released competing AI action plans within 72 hours—transforming artificial intelligence from a technological frontier into the central arena of 21st-century power projection. The U.S. “Winning the AI Race” plan champions private-sector dynamism, export controls, and infrastructure acceleration under the rallying cry “Build, Baby, Build!” It frames compute capacity as the new oil—a strategic commodity demanding deregulated construction of data centers, chip fabs, and nuclear plants.

China’s “Global AI Governance Action Plan” counters with state-orchestrated multilateralism. Positioned as a benevolent steward, Beijing declares AI an “international public good” and pledges to support Global South nations with sovereign AI kits—tailored data centers, compliance frameworks, and technical training. This divergence isn’t merely technical; it’s ideological. As the Atlantic Council notes, one vision prioritizes market-driven alliances, the other state-controlled sovereignty.

China’s Efficiency Gambit: Closing the Gap Against All Odds

Despite U.S. semiconductor bans, Chinese labs engineered shocking breakthroughs through algorithmic ingenuity:

- DeepSeek’s R1 model matched GPT-4’s performance at 6-7% of the cost using a Mixture-of-Experts (MoE) architecture. By activating only specialized neural subnetworks per query, it slashed GPU needs from 16,000 to 2,000.

- Tencent’s Hunyuan-Large scored 90.8% on the MMLU “AI IQ test,” edging past Meta’s Llama 3 (88.5%), while Alibaba’s Qwen 2.5 rivaled GPT-4 in coding.

- Cost revolution: DeepSeek’s API pricing stunned the industry at $0.55/million input tokens—1/27th of OpenAI’s o1 model. This triggered price cuts across Baidu, Tencent, and iFlytek.

Stanford’s 2025 AI Index confirmed the narrowing gap: Performance differences on benchmarks like MMLU collapsed from double digits in 2023 to under 2% by early 2025.

“China has rapidly evolved from a copycat into a true innovator. Their focus on affordability could democratize AI for billions.”

—Kai-Fu Lee, CEO of Sinovation Ventures

America’s Counterstrike: Compute as a Weapon

Facing China’s surge, the U.S. leveraged structural advantages:

- Investment firepower: Private capital poured $109.1 billion into U.S. AI in 2024—12× China’s total and 24× the U.K.’s. This funds moonshots like OpenAI’s “Stargate” initiative targeting 300,000 GPUs by 2026.

- Gulf enclaves: In Abu Dhabi and Riyadh, the U.S. deployed digital sovereignty packages—UAE’s G42 secured 500,000 Nvidia chips, while Saudi HUMAIN launched 500MW data centers backed by Oracle and AMD. These include binding U.S. security audits to counter Chinese “surveillance stacks”.

- Open-weight diplomacy: OpenAI’s surprise release of gpt-oss-120B—its first open-weight model since 2019—aimed to counter DeepSeek’s global adoption. Sam Altman admitted: “If we didn’t do it, the world was gonna head to be mostly built on Chinese open-source models”.

The Hidden Battle: Energy, Chips, and the Fragile Grid

Power demands now dictate AI scalability:

- China’s coal conundrum: Data centers consumed 140B kWh in 2024 (Sweden’s annual usage), projected to triple by 2035. Rural coal plants power 70% of this, clashing with climate goals.

- America’s grid crisis: California faces rolling blackouts as data centers spike electricity demand. The Trump administration fast-tracked permits for gas/nuclear plants, explicitly deprioritizing emissions concerns.

- Chip chokeholds: U.S. export controls forced ByteDance onto Huawei’s 20%-slower Ascend chips, inflating training costs 30%. Yet China retaliated by stockpiling 1.5 million Nvidia GPUs pre-ban.

“Constraints forced Chinese labs to innovate, but efficiency gains can’t offset fundamental hardware gaps forever.”

—Ajit Jaokar, AI Ambassador, University of Oxford

The Global South: Proxy War for Hearts, Minds, and Stacks

China courts allies through UN-centric diplomacy:

- Pushing AI standards via the International Telecommunication Union (ITU), positioning itself as the Global South’s champion against “Western tech hegemony”.

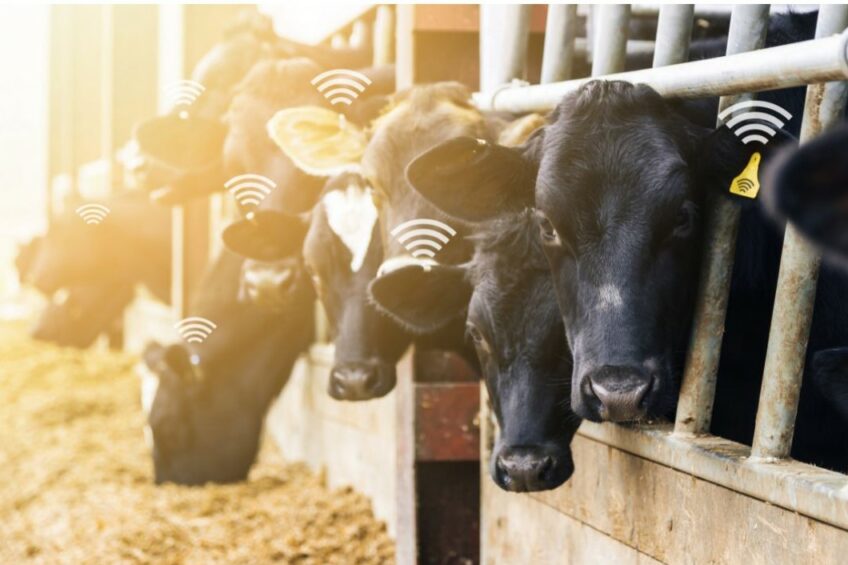

- Exporting Belt and Road AI kits: Huawei’s “AI-in-a-Box” offers turnkey solutions for emerging economies, bundled with training on Chinese compliance frameworks.

The U.S. responds with ecosystem enmeshment:

- Linking data center deals (e.g., G42’s UAE complex) to Five Eyes–level security partnerships, requiring alignment on data localization and AI ethics.

- Offering tax incentives for nations adopting U.S.-aligned open-weight models, framed as “digital sovereignty without dependence”.

The Unsettled Future: Coexistence or Collision?

Three scenarios loom for 2026–2030:

- Fractured technospheres: A “splinternet” for AI where U.S.-aligned nations run on Nvidia/Oracle stacks, China’s sphere uses Ascend/Huawei, with limited interoperability.

- Rogue actor proliferation: Non-state groups weaponize open-weight models for bioweapons design or disinformation—a threat both powers claim to oppose yet fuel via tech exports.

- Reluctant cooperation: Joint pacts on nuclear safeguard rails (“human control only”) could emerge, building on 2024’s bilateral pledge.

“The U.S. and China aren’t racing toward a finish line—they’re circling an endless track. Leadership won’t be decided by algorithms alone, but by who powers them, governs them, and makes them indispensable to the world.”

—Fei-Fei Li, Stanford HAI

Sources: Stanford HAI AI Index 2025, Atlantic Council, Brookings Institution, Forbes, CNBC, WisdomTree ETF Trends.

Additional Reporting: Konstantinos Komaitis (Atlantic Council), Ryan Hass (Brookings), Moin Roberts-Islam (Forbes).

Additional Reporting: Konstantinos Komaitis (Atlantic Council), Ryan Hass (Brookings), Moin Roberts-Islam (Forbes).