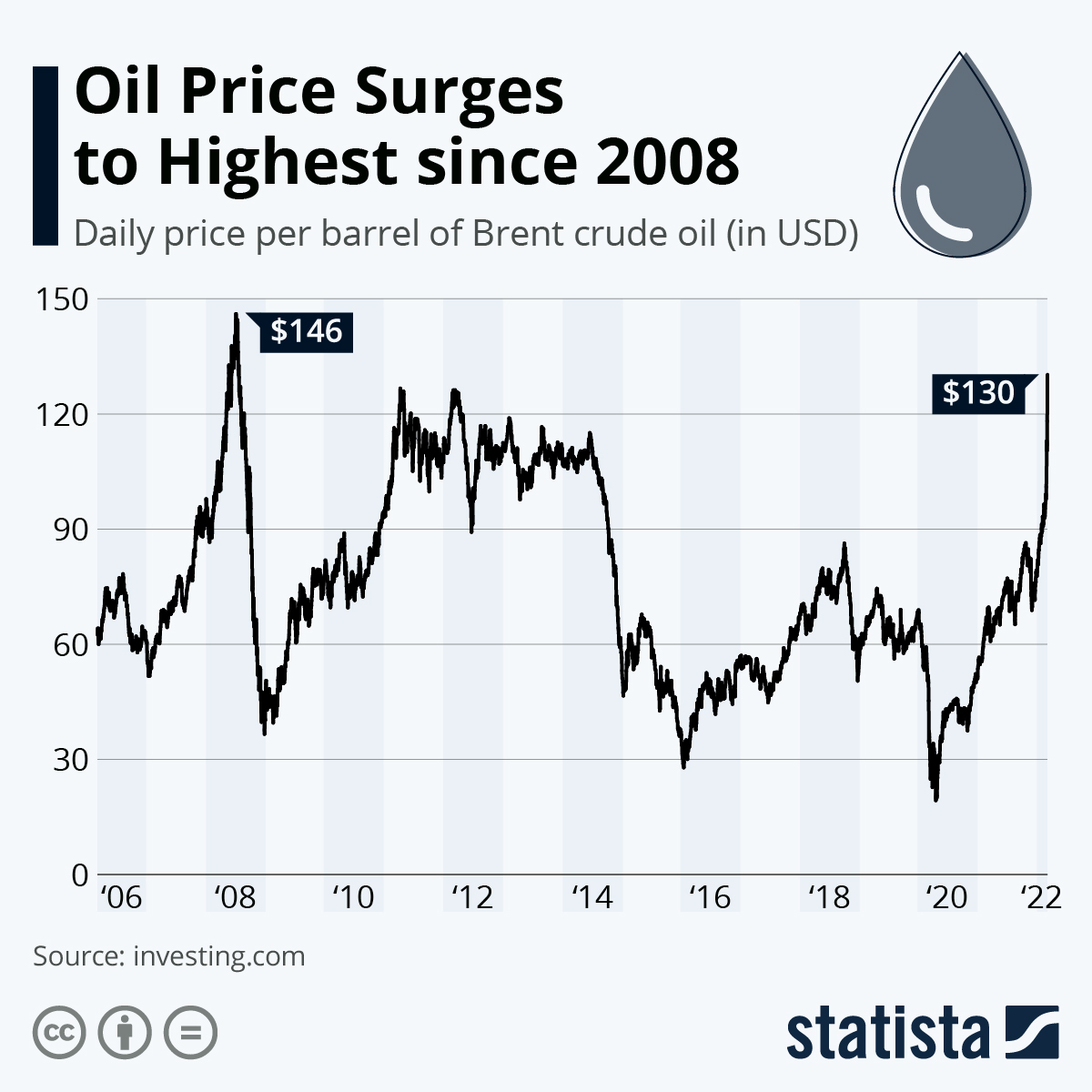

When global oil prices surge, the ripple effect is felt in every corner of the world. But in Kenya, where fuel is central to nearly every sector from farming and transport to manufacturing and electricity, these fluctuations hit harder than most citizens can bear. The big question remains: who truly shoulders the burden of rising oil costs? Governments, businesses, or ordinary consumers?

Oil prices are largely shaped by international forces:

Oil prices are largely shaped by international forces:

- OPEC+ decisions on production quotas.

- Geopolitical tensions, like wars in oil-rich regions.

- Global demand shifts, especially after COVID-19 and during economic recovery phases.

For developing nations like Kenya, this means they remain price takers, with limited control over global oil dynamics.

Below is a well explained breakdown of the control chain:

Local Consumers at the Frontline

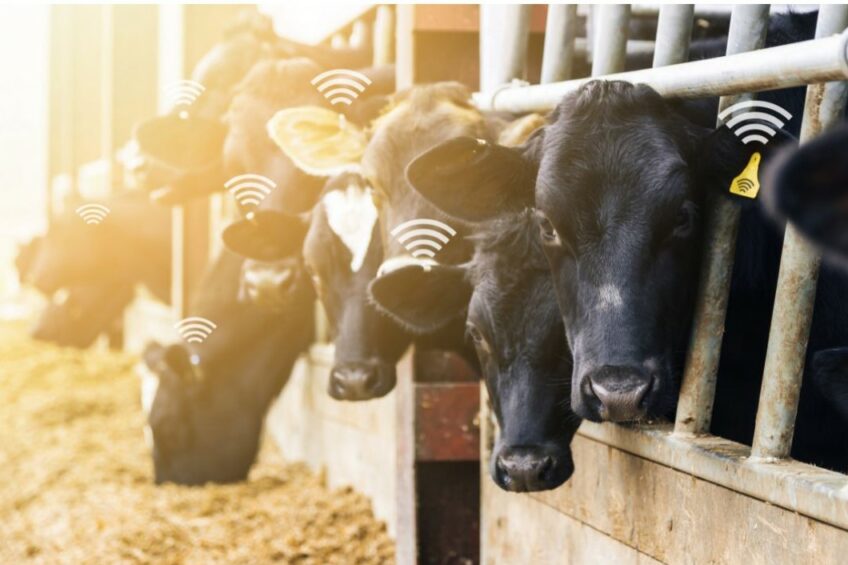

When prices spike, local transport costs rise instantly. Matatu fares shoot up, boda-boda riders charge more, and the ripple effect extends to food prices, housing, and even school fees. For a Kenyan earning minimum wage, fuel price hikes translate to a heavier cost of living.

Government's Role

Kenya’s government attempts to cushion citizens through:

- Fuel subsidies (though often unsustainable long-term).

- Price stabilization funds.

- Tax adjustments—yet levies like VAT and excise duty still make up a large chunk of pump prices.

Critics argue that taxes on petroleum products, while boosting government revenue, unfairly increase the burden on low-income households.

Businesses and the Domino Effect

Companies face higher operational costs especially in logistics and manufacturing. While big corporations may absorb part of the shock, SMEs often pass the costs directly to consumers, further fueling inflation.

And now, Who Bears the Real Burden?

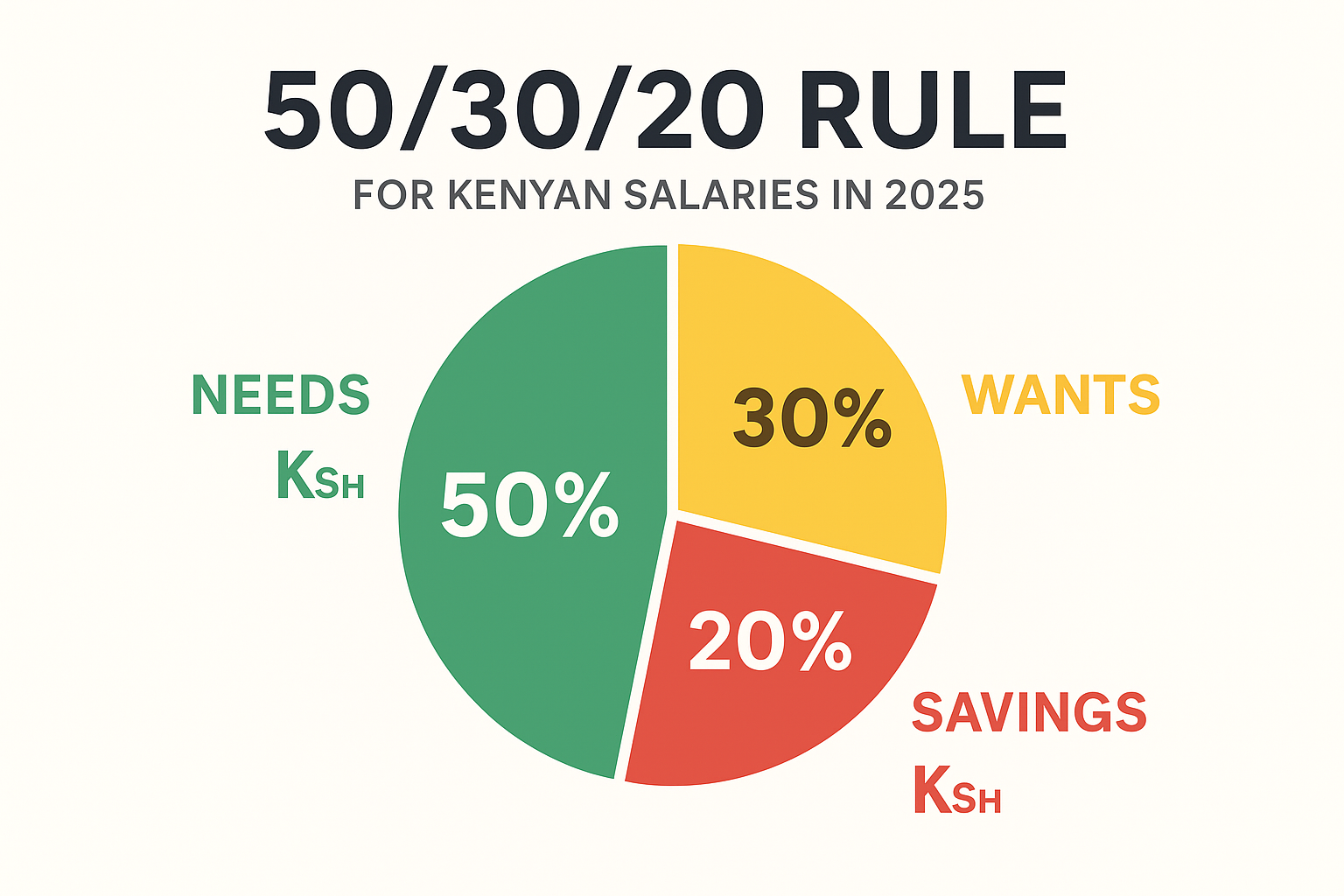

In reality, the ordinary Kenyan consumer feels the greatest pinch. Governments can adjust tax policies, and businesses can innovate or diversify, but citizens at the grassroots are left to stretch their already thin incomes.

Kenya needs to:

Businesses and the Domino Effect

Companies face higher operational costs especially in logistics and manufacturing. While big corporations may absorb part of the shock, SMEs often pass the costs directly to consumers, further fueling inflation.

And now, Who Bears the Real Burden?

In reality, the ordinary Kenyan consumer feels the greatest pinch. Governments can adjust tax policies, and businesses can innovate or diversify, but citizens at the grassroots are left to stretch their already thin incomes.

Kenya needs to:

- Explore alternative energy sources (solar, wind, electric mobility).

- Push for regional oil deals to reduce vulnerability to global shocks.

- Revisit taxation policies on petroleum to ensure fairness.

What’s your take, should the government cut fuel taxes to ease the burden, or should Kenya double down on renewable energy to escape the oil trap? Share your thoughts below!